UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

FOOT LOCKER, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

(1) | Title of each class of securities to which transaction applies: | |

|

|

|

| ||

(2) | Aggregate number of securities to which transaction applies: | |

|

|

|

| ||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

|

| ||

(4) | Proposed maximum aggregate value of transaction: | |

|

|

|

| ||

(5) | Total fee paid: | |

|

|

|

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

(1) | Amount Previously Paid: | |

|

|

|

| ||

(2) | Form, Schedule or Registration Statement No.: | |

|

|

|

| ||

(3) | Filing Party: | |

|

|

|

| ||

(4) | Date Filed: | |

|

|

|

is an athletically-inspired retailer focused on the large and rapidly growing Hispanic consumer demographic, operating a fleet of off-mall stores in key markets across California, Texas, Arizona, and Nevada. WSS’s community-driven business benefits from deep relationships with customers– with approximately 80% of its sales coming from customers who are members of its loyalty program. Foot Locker, Inc. benefits from WSS’s differentiated market position and complementary customer base and real estate portfolio. WSS’s assortment of classic styles further diversifies Foot Locker, Inc.’s product mix, enabling the Company to serve a broader range of consumer needs across price points.

is a culturally-connected brand featuring premium sneakers and apparel, an exclusive in-house label, collaborative relationships with leading vendors in the sneaker ecosystem, experiential stores, and a robust omni-channel platform. This acquisition accelerates Foot Locker, Inc.’s global reach with a highly-strategic foothold in Japan, extends the Company’s premium and top-tier offerings, and increases its digital penetration.

330 West 34th Street

New York, New York 10001

April 12, 2019

Dear Fellow Shareholders:

Last year, I highlighted how our customers’ rapidly-changing preferences and shopping behaviors–fueled by access to information, influences, and ideas from around the world–were challenging for our Company and the broader retail industry. This year, I am pleased to report that, by focusing on our commitment to elevate the customer experience across each of our channels and leveraging our strategic brand partnerships, we continued to differentiate our business and build positive momentum through each quarter of 2018. In 2019, we will continue to build on our strengths and seize opportunities to evolve our business by developing our internal assets and expanding into new markets.

Everything we do starts with the customer. Our new strategic framework is built on knowing, engaging, and serving our customers–wherever and however they want to interact with us–in store or online. By executing against this framework, we believe we will have the focus and tools to achieve our four key strategic imperatives:

|  |  |  |

| FORWARD-LOOKING STATEMENTS | iii | ||

| NOTICE OF ANNUAL MEETING | 1 | ||

| MESSAGE FROM OUR CHAIRMAN AND CEO | 3 | ||

| ABOUT FOOT LOCKER, INC. | 5 | ||

| Inspire and Empower Youth Culture | 5 | ||

| Our Strategic Imperatives | 5 | ||

| Our ESG Program | 6 | ||

| Our Climate Stewardship | 6 | ||

| Our Fiscal 2021 Highlights | 7 | ||

| Emerging Stronger from the COVID-19 Pandemic | 7 | ||

| Learn More About Our Company | 7 | ||

| VOTING ROADMAP | 8 | ||

| RECOGNITION | 13 | ||

|

| |

| Director Qualifications |

| |

| Director Nominees at a Glance |

| |

| Director Nominees’ Skillset Matrix |

|

|

Welcome to the Foot Locker, Inc. 2019 Annual Meeting of Shareholders

We continuously look for new and better ways to foster a diverse and inclusive work environment, engage our surrounding communities, improve employee safety, and minimize our environmental impact, all while creating value for our shareholders.

The Notice of 2019 Annual Meeting of Shareholders and Proxy Statement contain details of the business to be conducted at the 2019 Annual Meeting.

Your vote is very important to us, so regardless of whether you attend the meeting, please vote your shares.

This is an exciting time for Foot Locker, Inc. We are proud of what we accomplished in 2018, but we are just getting started on our new journey toinspire and empower youth culture. By focusing on our strategic imperatives, leveraging our global presence, and putting the customer at the center of everything we do, we believe we will build upon last year’s momentum and deliver against our updated long-term goals. I look forward to sharing our success with each of you at the 2019 Annual Meeting.

Sincerely,

|

|

| Compensation Discussion and

| 50 |

330 West 34th Street

New York, New York 10001

| 2022PROXY STATEMENT |

|

| Foot Locker Puerto Rico 1165(e) Plan, as amended and restated |

| 401(k) Plan | Foot Locker 401(k) Plan, as amended and restated |

| Annual Incentive Plan | Foot Locker Executive Incentive Cash Compensation Plan |

| Annual Meeting | 2022 Annual Meeting of Shareholders |

| Annual Report | Annual Report on Form 10-K for the year ended January 29, 2022 |

| Board | Board of Directors |

| CACM | Consistently Applied Compensation Measure |

| CAP | Compensation Advisory Partners |

| CCPA | California Consumer Privacy Act |

| CD&A | Compensation Discussion and Analysis |

| Common Stock | Foot Locker’s Common Stock, par value $0.01 per share |

| Company/Foot Locker | Foot Locker, Inc. |

| Corporate Headquarters | 330 West New York, New York 10001 |

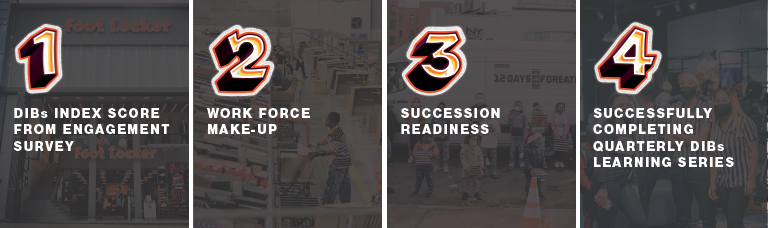

| DIBs | Diversity, Inclusion, and Belonging |

| DSU | Deferred Stock Unit (an accounting equivalent of one share of Common Stock) |

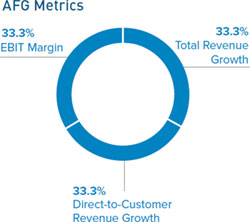

| DTC | Direct-to-Customer |

| EDT | Eastern Daylight Time |

| ERG | Employee Resource Group |

| ERISA | Employee Retirement Income Security Act of 1974, as amended |

| ESG | Environmental, Social, and Governance |

| ESPP | 2013 Foot Locker Employees Stock Purchase Plan |

| Excess Cash Plan | Foot Locker Excess Cash Balance Plan |

| Excess Savings Plan | Foot Locker Excess Savings Plan |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| FASB | Financial Accounting Standards Board |

| FDRA | Footwear Distributors and Retailers of America |

| Finance Committee | Finance and Investment Oversight Committee |

| GAAP | U.S. Generally Accepted Accounting Principles |

| GDPR | EU General Data Protection Regulation |

| GHG | Greenhouse Gas |

| Human Capital Committee | Human Capital and Compensation Committee |

| IAP | International Assignment Policy |

| Interest Account | a hypothetical investment account bearing interest at the rate of 120% of the applicable federal long-term rate, compounded annually, and set as of the first day of each plan year |

| IRC | Internal Revenue Code of 1986, as amended |

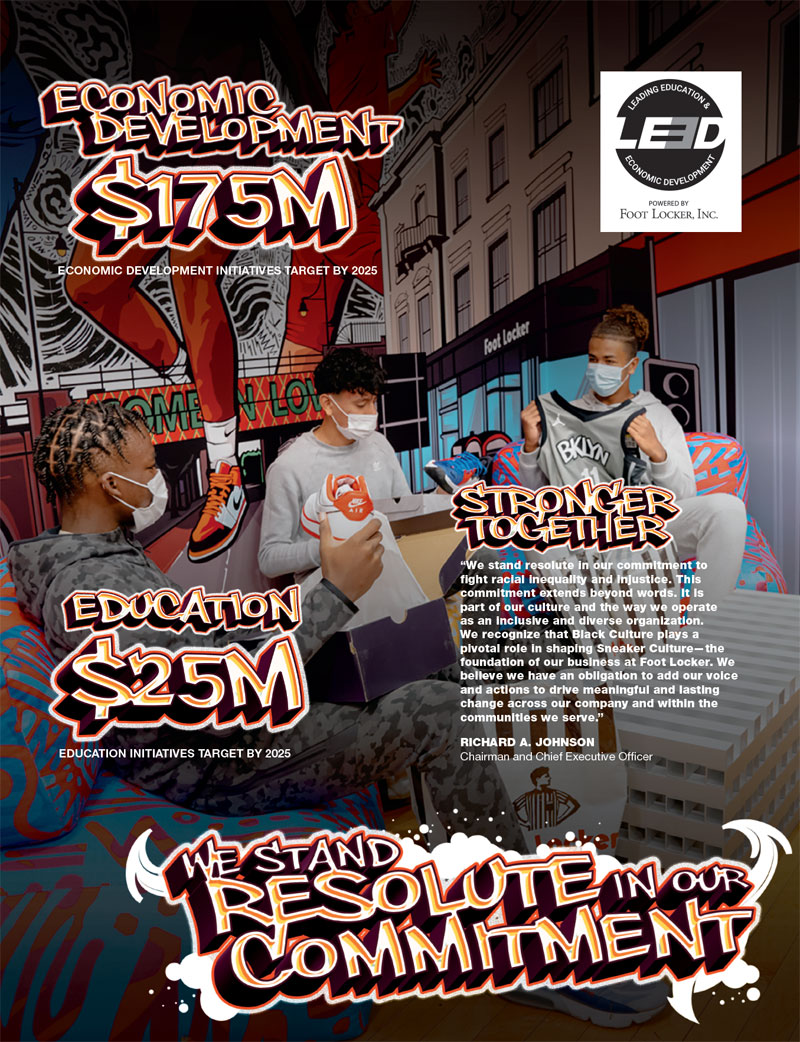

| LEED | Leading in Education and Economic Development |

| LTI | Foot Locker Long-Term Incentive Program |

| NACD | National Association of Corporate Directors |

| NEO | Named Executive Officer |

| Notice | Notice of Internet Availability of Proxy Materials |

| NPS | Net Promoter Score |

| NYSE | New York Stock Exchange |

| PCAOB | Public Company Accounting Oversight Board |

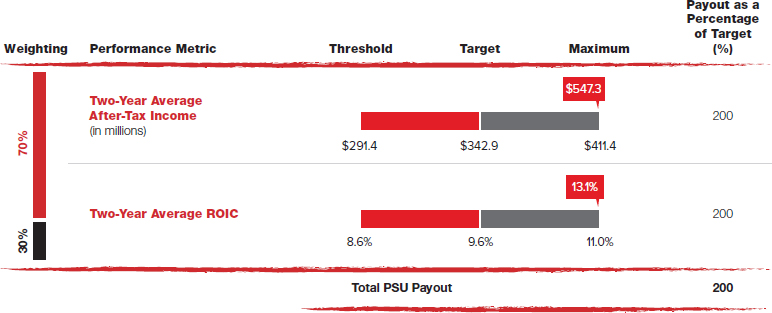

| PSU | Performance Stock Unit |

| Record Date | March 21, 2022 |

| Responsibility Committee | Nominating and Corporate Responsibility Committee |

| Retirement Plan | Foot Locker Retirement Plan, as amended and restated |

| RILA | Retail Industry Leaders Association |

| ROIC | Return on Invested Capital |

| RSU | Restricted Stock Unit (time-based) |

| SASB | Sustainability Accounting Standards Board |

| SEC | U.S. Securities and Exchange Commission |

| SERP | Foot Locker Supplemental Executive Retirement Plan, as amended and restated |

| Stock Incentive Plan | Foot Locker 2007 Stock Incentive Plan, as amended and restated |

| TCFD | Task Force on Climate-related Financial Disclosures |

| TSR | Total Shareholder Return |

| VIF | Voting Instruction Form |

| Foot Locker, Inc. |

This Proxy Statement contains forward-looking statements within the meaning of the U.S. securities laws. Other than statements of historical facts, all statements that address activities, events, or developments that the Company anticipates will or may occur in the future, including, but not limited to, future merchandise and vendor mix, real estate opportunities, acquisitions, strategic partnerships, capital expenditures, dividend payments, share repurchases, strategic plans, financial objectives, growth of the Company’s business and operations, and other such matters, are forward-looking statements. These forward-looking statements are based on many assumptions and factors, which are detailed in the Company’s filings with the SEC.

These forward-looking statements are based largely on our expectations and judgments and are subject to a number of risks and uncertainties, many of which are unforeseeable and beyond our control. For additional discussion on risks and uncertainties that may affect forward-looking statements, see “Risk Factors” disclosed in the Annual Report and subsequent filings with the SEC. Any changes in such assumptions or factors could produce significantly different results. The Company undertakes no obligation to update forward-looking statements, whether as a result of new information, future events, or otherwise. Website references throughout this Proxy Statement are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this Proxy Statement.

| 2022PROXY STATEMENT |  iii |

This page intentionally left blank.

| DATE AND TIME May 18, 2022 at 9:00 a.m. EDT |  | VIRTUAL MEETING SITE virtualshareholdermeeting.com/FL2022 |  | RECORD DATE Shareholders of record as of March |

Items of Business

| ||

| ||

| ||

Transact such other business as may properly come before the meeting and at any adjournment or postponement of the meeting

Proxy Voting

You may vote using any of the following methods:

| ||

| ||

| ||

| ||

|

All shares that have been properly voted and not revoked will be voted at the Annual Meeting. If you sign and return a proxy card but do not give voting instructions, the shares represented by that proxy card will be voted as recommended by the Board.

Your vote is very important to us. Please exercisevote your right to vote.shares.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 22, 2019ITEMS OF BUSINESS

The Company’s Proxy Statement and 2018 Annual Report on Form 10-K are available atmaterials.proxyvote.com/344849.

April 12, 2019

Sheilagh M. Clarke

Senior Vice President,

General Counsel and Secretary

Proxies are being solicited by the Board of Directors of Foot Locker, Inc. (NYSE: FL) (“Foot Locker,” the “Company,” “we,” “our,” or “us”) to be voted at our 2019 Annual Meeting. As this is a summary of our Proxy Statement, please refer to the complete Proxy Statement for more complete information.

2019 Annual Meeting of Shareholders

|   | Elect ten |  | ||

| |||||

|

| ||||

On or about April 12, 2019, we started mailing a Notice Regarding the Internet Availability of Proxy Materials to our shareholders.

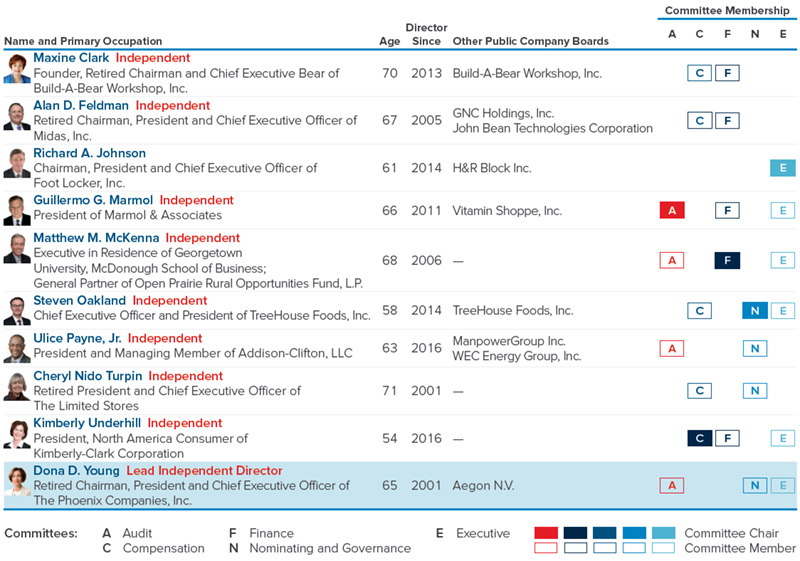

Director Nominees

Ten directors are standing for election at the 2019 Annual Meeting for one-year terms. The table below provides summary information about each of the nominees for director. See pages 6 through 12 for additional information about each nominee and pages 25 through 27 for additional information about the Committees of the Board.

|

Proxy Statement Summary

Board Snapshot

Attendance

Over97%Attendance of Directorsat Board and Committee Meetings in 2018

Independence

9out of10directors are independent

All directors are independent, except the CEO

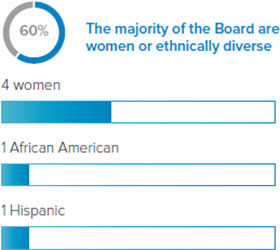

Diversity

Our directors represent a range of backgrounds and experience. The majority are women or ethnically diverse. Our Nominating and Corporate Governance Committee (the “Nominating and Governance Committee”) is focused on ensuring continued diversity on the Board—in terms of gender, age, ethnicity, skills, business experience, service on our Board and the boards of other organizations, and viewpoints—during refreshment activities by requiring that candidate pools include diverse individuals meeting the recruitment criteria.

Tenure

Directors with varied tenure contribute to a range of perspectives and ensure we transition knowledge and experience from longer-serving members to those newer to our Board. We have a good mix of new and longer-serving directors.

Refreshment

3 New Directors Added Over Past Five Years

3 Directors Retired Over Past Five Years

Age

|

Proxy Statement Summary

Environmental, Social, and Governance Highlights

The Company and the Board are focused on corporate social responsibility. We continuously look for new and better ways to foster a diverse and inclusive work environment, engage our surrounding communities, improve employee safety, and minimize our environmental impact, all while creating value for our shareholders. Below are some recent highlights of our diversity and sustainability initiatives.

| ||||||||||

| Item | ||||||||||

| Vote, on an advisory basis, to approve the Company’s NEOs’ compensation |   | FOR |  | ||||||

| Votes Cast by | ||||||||||

| Item | Shareholders | |||||||||

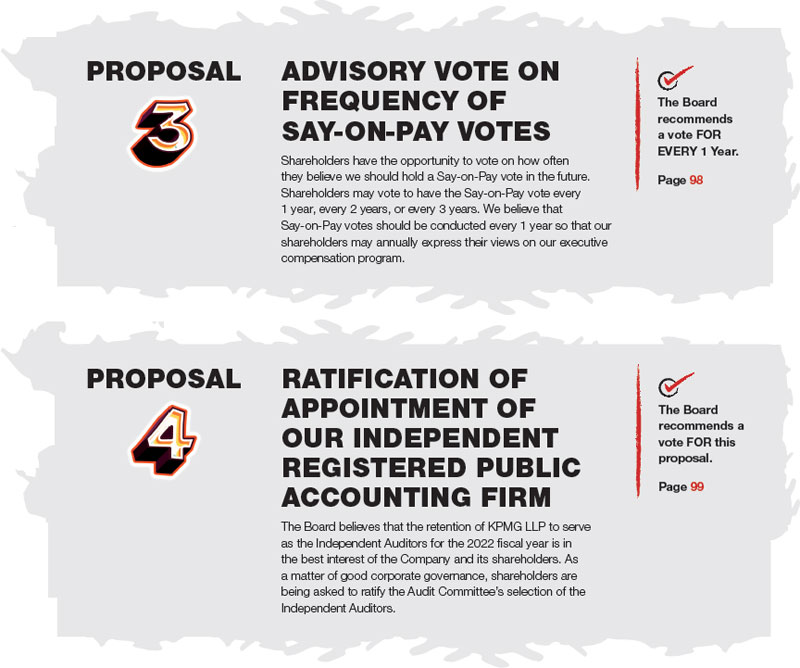

| Vote, on an advisory basis, on whether the shareholder vote to approve the Company’s NEOs’ compensation should occur every 1, 2, or 3 years |   | FOR 1 year | |||||||

| Item | ||||||||||

|  | |||||||||

| FOR | ||||||||||

| ||||||||||

Transact such other business as may properly come before the Annual Meeting and at any adjournment or postponement of the meeting | ||||||||||

| 2022PROXY STATEMENT |  1 |

NOTICE OF ANNUAL MEETING

PROXY VOTING

You may vote using any of the following methods:

TELEPHONE |  | |

SCANNING | You may scan the QR Code provided to you to vote your shares through the internet with your mobile device. Internet voting is available 24 hours per day and will be accessible until 11:59 p.m. EDT on May 17, 2022. You will be able to confirm that the system has properly recorded your vote. If you scan your QR code to vote, you do NOT need to return a proxy card or VIF. | |

AT THE | You may vote at the virtual Annual Meeting using the 16-digit control number included on your Notice, proxy card, and VIF that accompanied your proxy materials. | |

INTERNET | ||

| If you received printed copies of | |

APP | You may vote your shares by using the ProxyVote app. Download the app from the App Store or Google Play, scan or enter your control number, and | |

* U.S. workforce represents 74%

Important Notice Regarding the Availability of global workforce.Proxy Materials for the Annual Meeting to be Held on May 18, 2022

The Company’s Proxy Statement and Annual Report are available at materials.proxyvote.com/344849.

April 8, 2022

SHEILAGH M. CLARKE

Executive Vice President, General Counsel and Secretary

|

Proxy Statement Summary

Recognition

For additional information, seeEnvironmental, Social, and Governance Highlightsbeginning on page 20.

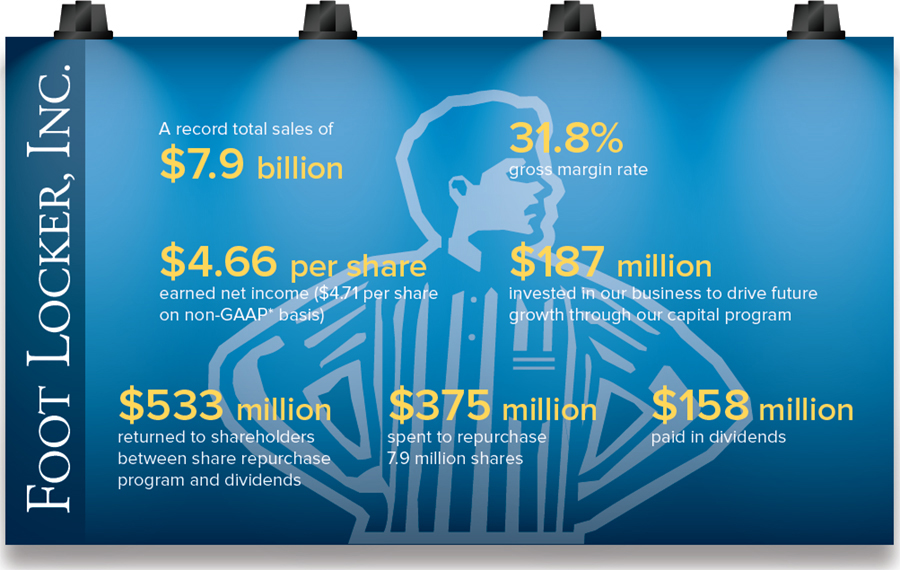

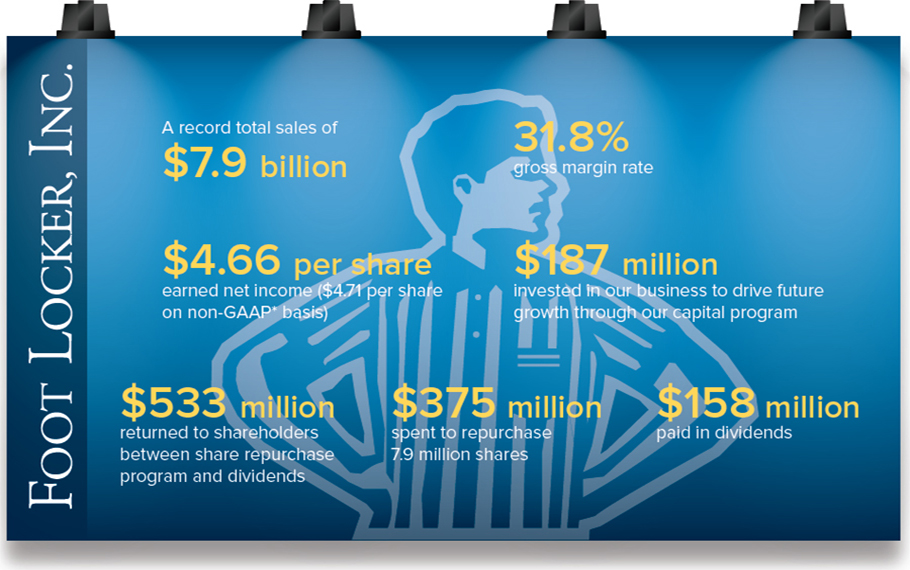

Fiscal 2018 Results

We built positive momentum and improved our financial results in 2018. Highlights include the following:

| Foot Locker, Inc. |

DEAR FELLOW SHAREHOLDERS:

Despite the many challenges we confronted and are continuing to experience—including impacts related to the COVID-19 pandemic, supply chain disruption, inflationary pressures, and an evolving geopolitical environment—we delivered record performance in 2021, which reflects the ongoing momentum we have built in our business. I believe the strategic decisions we have made throughout this period have put the Company in a position of strength to confront certain headwinds in the marketplace, including accelerated strategic shifts to DTC by our vendors, and succeed over the long term by creating shareholder value. Let me share with you a few recent highlights:

| ► | Merchandise and Vendor Diversification. Our journey to diversify our mix of business and expand our reach as a house of brands is ongoing. We made significant progress diversifying our brands, categories, and channels in 2021. We also expanded our customer base across demographics and high-growth geographies with the acquisitions of WSS and atmos. We made investments in our omni-channel platform to advance our DTC offense and expanded our private label merchandise offerings. We will accelerate these initiatives and others in 2022 as a part of our long-term strategy to strengthen our position at the intersection of youth culture, sports and lifestyle, and the sneaker community. |

| ► | Investments in Growth. We added two high-growth companies–WSS and atmos–to the Foot Locker, Inc. family in 2021, each with its own differentiated strengths. These strategic acquisitions expand our customer base and geographic reach, strengthen our store footprint, and further diversify our product mix across consumers and price points. WSS, which we expect to double to approximately $1 billion of sales by 2024, gives us a strong off-mall presence in fast-growing markets with a full family offering and a special connection to the Hispanic community. atmos, which we expect to grow by 30% to approximately $300 million of sales over the next three years, provides us with a foothold in Japan and a key launching point into the rest of Asia with a digitally-led business model that combines premium product and creative collaborations to create excitement around the banner. |

| ► | Climate Stewardship. Management and the Board have established ESG as a priority for the Company. We are committed to helping our planet remain a sustainable home for current and future generations. Unabated climate change presents risks for our business, industry, and society, but through climate stewardship, we may unlock opportunities to innovate and strengthen our relationships with our customers and the communities we serve. We recently announced our ambition to achieve net zero GHG emissions by 2050 or sooner, in alignment with climate scientists’ recommendations to transition toward a net zero state and avoid the worst impacts of climate change. We have also committed to setting a science-based target in line with the criteria established by the Science Based Target initiative (SBTi) and report our progress against certain metrics regarding our GHG emissions annually in our Impact Report, which is available at investors.footlocker-inc.com/impactreport, and is aligned with the reporting disclosure guidance of the SASB industry standards and the TCFD recommendations. This announcement marks an important milestone in our ESG journey. As the Company looks to fiscal 2022 and beyond, we are committed to building on this progress and strengthening our vision for a more sustainable world. To learn more about our efforts to power a more sustainable future, see ESG on page 96, and our Global Environmental and Climate Change Statement, which is available at investors.footlocker-inc.com/climate. |

| ► | Human Rights. Our human capital is our most important asset. Protecting our team members, our customers, and the communities we serve is one of the most pressing challenges we face. We are proud to create jobs and secure livelihoods for our team members, provide products and engagement for our customers, support community development, and provide tax revenue for governments around the world to invest in the well-being of their |

“

We know that our customer demands choice across a variety of brands and categories, so we continue to work to broaden our selection, including leaning into brands where we are under-penetrated, introducing new brand partners, and developing our own private labels.”

people. Specifically, we have policies in place to ensure that we and our partners maintain work environments that respect and support human rights for everyone in our value chain around the world. This is a public good for all stakeholders. For additional information regarding our human rights efforts, see ESG on page 96, our Impact Report, which is available at investors.footlocker-inc.com/impactreport, our Global Human Rights Statement, which is available at investors.footlocker-inc.com/ humanrights, and our Global Sourcing Guidelines, which are available at investors.footlocker-inc.com/gsg.

| ► | Organizational Enhancements. In November 2021, we made certain organizational enhancements, including elevating Frank Bracken to the new role of Executive Vice President and Chief Operating Officer. The addition of a Chief Operating Officer creates a more streamlined and agile organizational structure that builds on the success of our geo-focused growth strategy. We believe we will be in a stronger position to address new and emerging opportunities and to grow our connectivity with our consumers and the communities we serve. In March 2022, we recruited Samantha Lomow from outside the Company as our first President, Global Brands, reporting to Frank, to oversee our global brand portfolio and operating divisions across North America, EMEA, and APAC. Also, as part of a planned succession strategy, in April 2021, we recruited Andrew Page from outside the Company as Executive Vice President and Chief Financial Officer, succeeding Lauren Peters, who retired from the Company. Each of these organizational enhancements underscores our focus on aligning our team to drive productivity while we continue to pursue our global growth agenda. |

| ► | Board Refreshment. I want to thank Matt McKenna who will be retiring from the Board at the Annual Meeting after serving for 16 years. Matt’s extensive financial experience has been an invaluable source of insights, and I can say on behalf of the Board and myself that he will be truly missed. I also welcome Gina Drosos who joined our Board in February. Gina is a dynamic and transformative leader with an impressive background and track record. She embodies what we seek from our directors–an agile mindset, proven leadership, and innovative thinking. |

In addition to this Proxy Statement, I encourage you to review our Annual Report, which is available at investors.footlocker-inc.com/ar.

The Notice and this Proxy Statement each contains details of the business to be conducted at the Annual Meeting. Your vote is very important to us, so please vote your shares.

I am incredibly grateful to our team members, Board, customers, vendor partners, and shareholders.

Thank you for your support of our Company. I ask that you carefully consider the information in this Proxy Statement related to the proposals.

Sincerely,

RICHARD A. JOHNSON

Chairman and Chief Executive Officer

Learn more about the Board’s highlights from 2021 from our Lead Independent Director on page 28

INSPIRE AND EMPOWER YOUTH CULTURE

Foot Locker, Inc. (NYSE: FL) leads the celebration of sneaker and youth culture around the globe through a portfolio of brands, including Foot Locker, Kids Foot Locker, Champs Sports, Eastbay, atmos, WSS, Footaction, and Sidestep, including 2,858 operated stores, as well as websites and mobile apps, in 28 countries across North America, Europe, Asia, Australia, and New Zealand, in addition to 142 franchised stores in the Middle East and Asia.

We have established strategic imperatives for sustained performance centered around our customers:

| 2022PROXY STATEMENT |  5 |

ABOUT FOOT LOCKER, INC.

T

hereManagement and the Board understand that how we achieve our purpose is just as important as what results we achieve. We have long established ESG as a priority for the Company and are continuing to improve the environmental and social impacts of our business, measure the impacts we are making, and communicate with and drive accountability to our stakeholders. Our global ESG program is focused on four pillars:

To learn more about our global ESG program, see ESG on page 96, and our Impact Report, which is presented consistent with the SASB reporting standards and TCFD reporting framework and is available at investors.footlocker-inc.com/impactreport.

The Company recently announced its ambition to achieve net zero GHG emissions by 2050 or sooner.

For additional information regarding the Company’s efforts to power a more sustainable future, see ESG on page 96, the Company’s Impact Report, which is aligned with the reporting disclosure guidance of the SASB industry standards and the TCFD recommendations and is available at investors.footlocker-inc.com/impactreport, and the Company’s Global Environmental and Climate Change Statement, which is available at investors.footlocker-inc.com/climate.

6 | Foot Locker, Inc. |

ABOUT FOOT LOCKER, INC.

Despite the many challenges we confronted and are continuing to experience—including the COVID-19 pandemic, supply chain disruption, inflationary pressures, and an evolving geopolitical environment—we delivered record performance in 2021, which reflects the ongoing momentum we have built in our business. Highlights include the following:

| (1) | A reconciliation to GAAP is provided beginning on page 21 of our Annual Report, which is available at investors.footlocker-inc.com/ar. |

COVID-19 PANDEMIC

We recognize the human tragedy of the COVID-19 pandemic. Our foremost priority during the pandemic has been the health, safety, and security of our team members, our customers, and the communities we serve. Our approach is grounded in our Company’s purpose.

You can learn more about the Company by visiting footlocker.com/corp. We also encourage you to read our Annual Report, which is available at investors.footlocker-inc.com/ar.

| 2022PROXY STATEMENT |  7 |

DEMOGRAPHICS

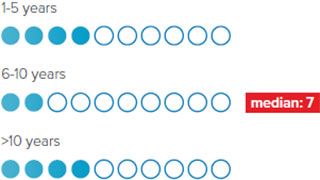

TENURE

| ► | 7 years (Median) |

| ► | Directors with varied tenure contribute to a range of perspectives and ensure we transition knowledge and experience from longer-serving members to those newer to our Board. We have a good mix of new and longer-tenured directors. |

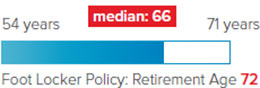

AGE

| ► | 63 years (Median) |

DIVERSITY

| ► | Our director nominees represent a diverse range of backgrounds—in terms of gender, age, ethnicity, skills, and business and board experience—with an equally diverse range of perspectives. What we share is a common desire to support and oversee management in achieving the Company’s purpose to inspire and empower youth culture. |

| ► | 70% of the director nominees are women or persons of color. |

| ► | 60% of our committees are chaired by women or persons of color. |

| ► | Our Responsibility Committee is focused on ensuring continued diversity on the Board during refreshment activities by requiring that candidate pools include diverse individuals meeting the relevant recruitment criteria. |

SKILLS AND EXPERIENCES

We believe that our slate of director nominees possesses the appropriate mix of diversity in terms of skills, business and Board experience, and viewpoints.

8 | Foot Locker, Inc. |

VOTING ROADMAP

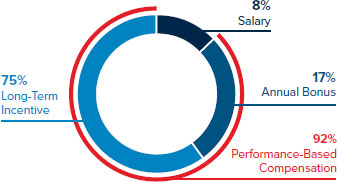

PAY-FOR-PERFORMANCE

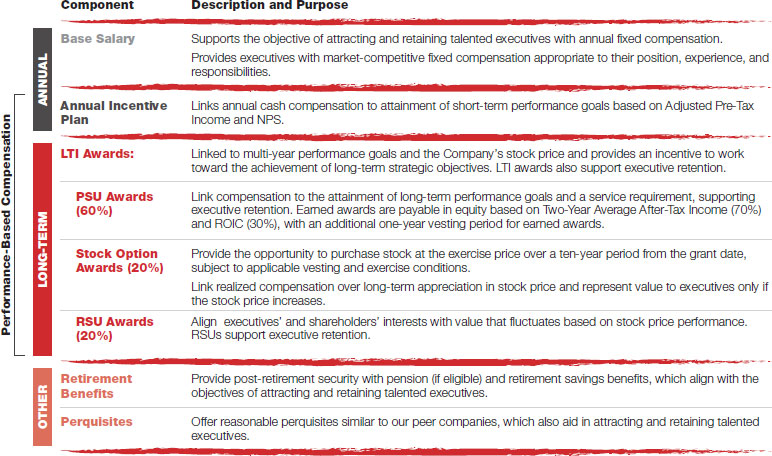

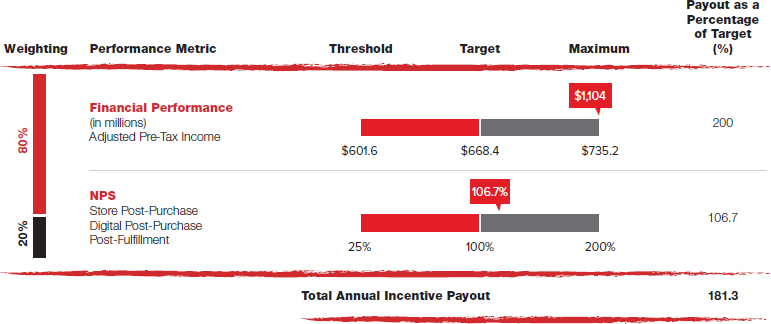

The centerpiece of our compensation program is our pay-for-performance philosophy that aligns compensation payouts with the achievements of our annual operating plan and long-term strategy, and consequently shareholder value. This is showcased at senior levels of the Company—particularly the CEO—for which most compensation is tied to the Company’s operating and stock performance, as described below.

| Factor | Description | |

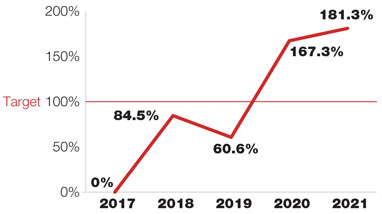

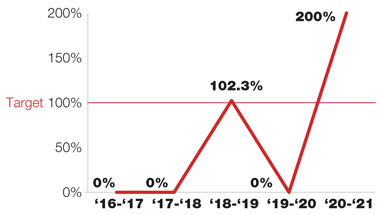

| Performance-Based | A significant proportion of the CEO’s compensation is performance-based. | |

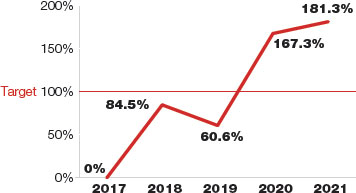

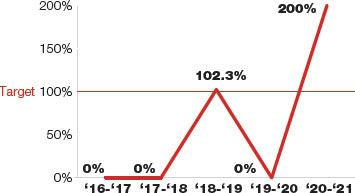

| Challenging Goals | Recent Annual Incentive Plan and LTI payouts underscore our pay-for-performance culture. For example, only twice in the past five years has the Annual Incentive Plan paid out greater than target and three of the past five PSU awards were not earned and paid out at 0%. | |

| Formulaic | Our Annual Incentive Plan and LTI payouts are formulaically determined based on performance against challenging financial and operating goals. | |

| Lower Realized Pay | The CEO’s five-year realized pay is expected to be lower than his five-year target compensation. | |

| Peer Benchmarked | We utilize an objective set of criteria to determine peer companies and position CEO pay at the peer group median. | |

| Reasonable | 2021 compensation for newly-appointed and outgoing executives was reasonable. | |

Responsive to Say-on-Pay Vote | Our Say-on-Pay support has been strong in recent years. | |

| Compensation Mix | Beginning with LTI awards granted in 2021, we adopted a consistent mix of PSU awards (60%), stock option awards (20%), and RSU awards (20%). |

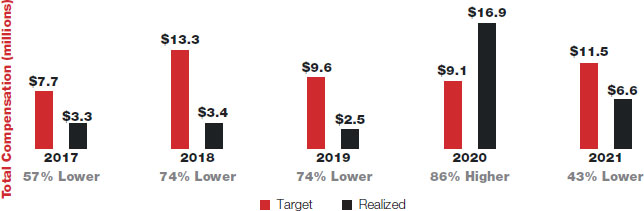

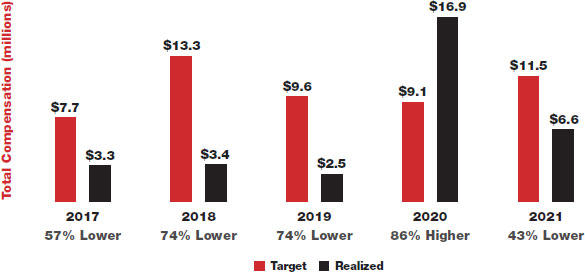

Recent Annual Incentive Plan and LTI payouts underscore our pay-for-performance culture:

| ANNUAL INCENTIVE PLAN | PSU AWARDS |

|  |

| 2022PROXY STATEMENT |  9 |

VOTING ROADMAP

TARGET COMPENSATION VS. REALIZED PAY(1)

Our executives’ realized pay over the past five years further reinforces our pay-for-performance philosophy. Failure to achieve the challenging threshold performance goals set for our Annual Incentive Plan awards and PSU awards results in no payout earned. Also, a decrease in the Company’s stock price results in a decrease in the value of previously-awarded stock option awards—potentially to $0—and no dilution to shareholders, as well as a decrease in the value of previously-awarded RSU awards. When our stock price increases and generates positive returns for our shareholders, the increase impacts an executive’s realized pay during the present fiscal year and for prior fiscal years during which the executive received equity awards that are held or still subject to vesting. Accordingly, a significant portion of our NEOs’ compensation is closely linked to the performance of our stock over time, motivating our executives to generate positive returns for shareholders.

The following chart demonstrates the relationship between the target and realized values of our CEO’s compensation for the past five years:

| (1) | For each year, these amounts reflect the CEO’s base salary paid, Annual Incentive Plan payouts paid, values of PSU awards earned, stock option award tranches vesting during the year, and RSU awards vesting during the year. For 2020, the CEO’s realized pay includes the value of a one-time Accelerate Future Growth award earned. |

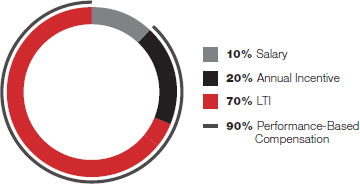

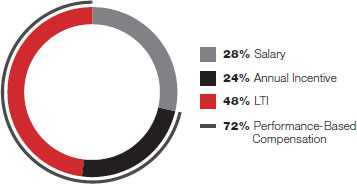

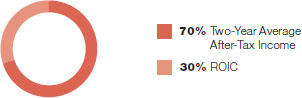

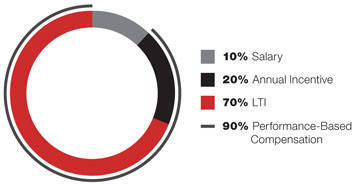

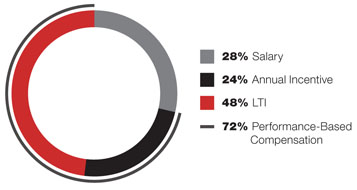

COMPENSATION MIX

The Human Capital Committee seeks to align the compensation program with both our business strategy and our shareholders’ interests. In order to achieve these objectives, our executive compensation program includes both a mix of annual and long-term, as well as cash and equity, compensation. As shown in the charts below, for 2021, 90% of the CEO’s target compensation mix, and 72%, on average, of the remaining NEOs’ target compensation mix, was performance based.

| CEO’s 2021 TARGET COMPENSATION | AVERAGE OF REMAINING NEOs’ 2021 |

| TARGET COMPENSATION | |

|  |

| ANNUAL INCENTIVE PLAN | LTI PERFORMANCE METRICS |

| PERFORMANCE METRICS | |

|  |

10 | Foot Locker, Inc. |

VOTING ROADMAP

On or about April 8, 2022, we started mailing a Notice to our shareholders.

Proxies are being solicited by the Board to be voted at our Annual Meeting.

| 2022PROXY STATEMENT |  11 |

This page intentionally left blank.

There are currently 1011 directors on our Board. TheMr. McKenna will be retiring when his term expires at the conclusion of the Annual Meeting, and the Board has fixed the number of directors at 10.10 effective at such time. All current directors other than Mr. McKenna are standing for election for a one-year term at this meeting.

We have refreshed our Board over the past five years, as threefive highly-qualified directors were added to the Board and, threeas of the Annual Meeting, five directors retired.will have retired during that time period. We believe that the Board possesses the appropriate mix of diversity in terms of gender, age, ethnicity, skills, business and Board experience, service on ourand viewpoints.

Our Responsibility Committee is charged with recommending director candidates to fill current and anticipated Board vacancies. The Responsibility Committee identifies and evaluates potential candidates from recommendations from the Company’s directors, management, shareholders, and other outside sources, including professional search firms. In evaluating proposed candidates, the Responsibility Committee may review their résumés, obtain references, and conduct personal interviews. The Responsibility Committee considers, among other factors, the Board’s current and future needs for specific skills and the boardscandidate’s experience, leadership qualities, integrity, diversity, ability to exercise judgment, independence, and ability to make the appropriate time commitment to the Board. The Responsibility Committee strives to ensure the Board has a rich mix of relevant skills, diversity, and experiences to address the Company’s needs.

In 2021, the Responsibility Committee conducted a search to identify and recruit an independent director candidate based on specific criteria it previously established, including CEO experience in the specialty retail sector and expertise requirements under the NYSE rules to serve as an audit committee member. The Responsibility Committee reviewed its findings with the Board. In conducting its search, the Responsibility Committee collected names of potential candidates from the Company’s directors and engaged a third-party search firm to identify and recruit qualified candidates. After reviewing the qualifications of the potential pool of candidates and narrowing the field to a few candidates, the Lead Independent Director and Responsibility Committee Chair each interviewed the candidates, the Chairman reviewed the finalists, and the full Board met the finalist. Based on the Responsibility Committee’s review, the candidates’ résumés, and the other organizations,directors’ and viewpoints.Board’s interviews with the candidates, the Responsibility Committee recommended and the Board approved the election of Virginia C. Drosos, who was identified by the third-party search firm.

Maxine Clark,Virginia C. Drosos, Alan D. Feldman, Richard A. Johnson, Guillermo G. Marmol, Matthew M. McKenna,Darlene Nicosia, Steven Oakland, Ulice Payne, Jr., Cheryl Nido Turpin, Kimberly Underhill, Tristan Walker, and Dona D. Young will be considered for election as directors to serve for one-year terms expiring at the 20202023 Annual Meeting. Each nominee has been nominated by the Board for election and has consented to serve. If, prior to the 2019 Annual Meeting, any nominee is unable to serve, then the persons designated as proxies for this meeting (Sheilagh(Andrew E. Page, Sheilagh M. Clarke, and John A. Maurer, and Lauren B. Peters)Maurer) will have full discretion to vote for another person to serve as a director in place of that nominee, or the Board may reduce the size of the Board.its size.

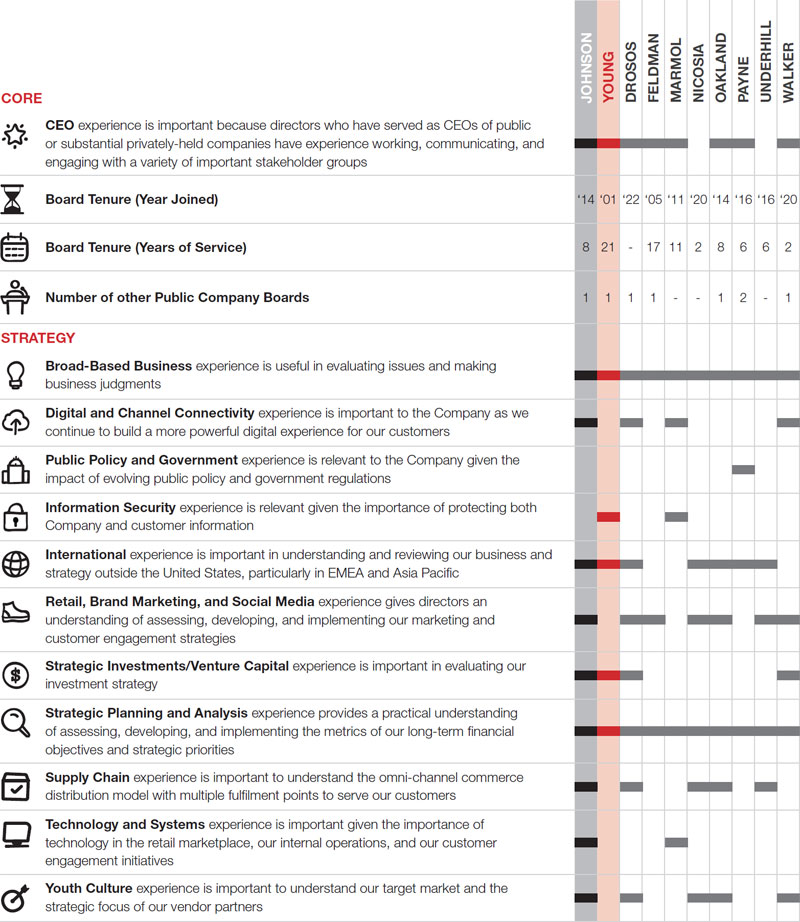

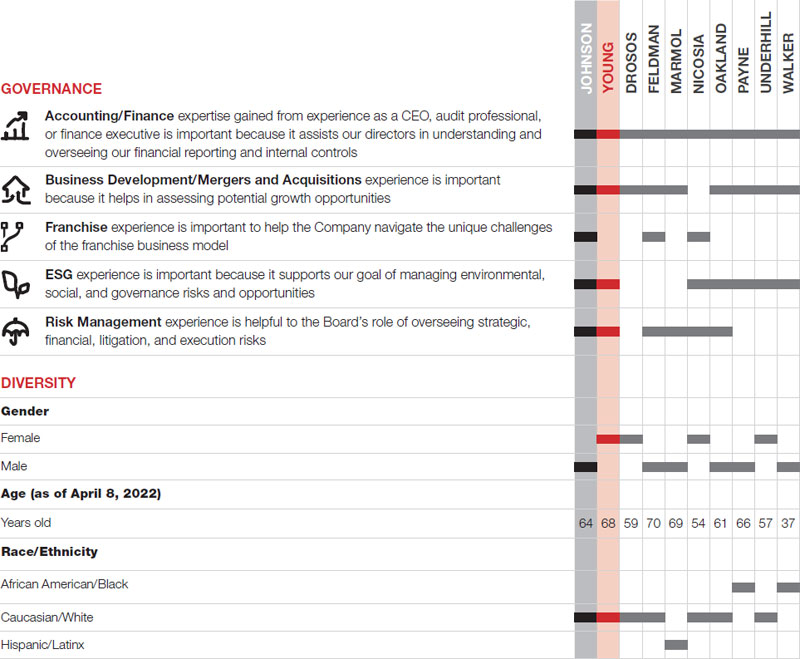

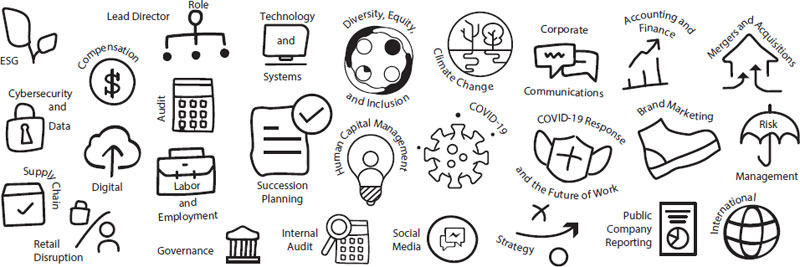

Director QualificationsDIRECTOR QUALIFICATIONS

The Nominating and GovernanceResponsibility Committee reviewed and updatedevaluated the skills, experience, and qualifications catalogued under the Director Nominees’ Skillset Matrix on pages 23 through 24, and demonstrated by the director skill-set matrixnominees, in light of the Company’s long-term strategic plan and evaluated the directors’ skills, experience, and qualifications under the updated matrix, which is shown beginning on page 11.plan.

The Board, acting through the Nominating and GovernanceResponsibility Committee, considers its members, including those directors being nominated for reelection to the Board at the 2019 Annual Meeting, to be highly qualified for service on the Board due to a variety of factors reflected in each director’s education, areas of expertise, and experience serving on theother organizations’ boards of directors of other organizations during the past five years. Generally, the Board seeks individuals with broad-based experience and the background, judgment, independence, and integrity to represent the shareholders in overseeing the Company’s management in their operation of the business. Within this framework, specific items relevant to the Board’s determination for each director are listed in each director’s biographical information beginning on page 6.18. The ages shown are as of April 12, 2019.8, 2022. There are no family relationships among our directors or executive officers.

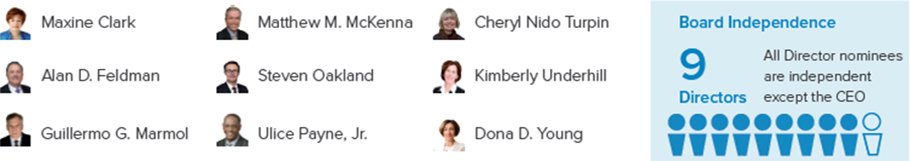

|

Proposal 1: Election OF Directors DIRECTOR NOMINEES AT A GLANCE Ten directors are standing for election at the Annual Meeting for one-year terms. Matthew M. McKenna will be retiring from the Board when his term expires at the conclusion of the Annual Meeting. The table below provides summary information about each of the nominees for director. See pages 18 through 22 for additional information about each nominee and pages 41 through 42 for additional information about the committees. TENURE 7 Median 3 0-2 years 4 3-8 years 3 >9 years Directors with varied tenure contribute to a range of perspectives and ensure we transition knowledge and experience from longer-serving members to those newer to our Board. We have a good mix of new and longer-tenured directors. AGE 63 Median 4 37-59 5 60-69 1 _70 ATTENDANCE 99% Over 99% aggregate attendance of directors at Board and committee meetings in 2021 Alan D. Feldman F H Independent Retired Chairman, President and Chief Executive Officer of Midas, Inc. Age: 70 Director Since: 2005 Other Public Company Board: John Bean Technologies Corporation Virginia C. Drosos A F Independent Chief Executive Officer of Signet Jewelers Limited Age: 59 Director Since: 2022 Other Public Company Board: Signet Jewelers Limited Darlene Nicosia A H Independent President, Canada and Northeast U.S., North America Operating Unit of The Coca-Cola Company Age: 54 Director Since: 2020 Richard A. Johnson E Chairman, President and Chief Executive Officer of Foot Locker, Inc. Age: 64 Director Since: 2014 Other Public Company Board: H&R Block Inc. Guillermo G. Marmol A E H Independent President of Marmol & Associates Age: 69 Director Since: 2011 16INDEPENDENCE director nominees are independent. All director nominees are independent, except the CEO.

|

|  |

|

|  |

|

|

Proposal 1: Election OF Directors COMMITTEES A Audit E Executive F Finance H Human Capital R Responsibility Committee Chair DIVERSITY Our director nominees represent a diverse range of backgrounds—in terms of gender, age, ethnicity, skills, and business and board experience—with an equally diverse range of perspectives. What we share is a common desire to support management in achieving the Company’s purpose to inspire and empower youth culture. 70% of the director nominees are women or persons of color 60% of committees are chaired by women or persons of color Hispanic/ Latinx African American/ Black Women 0 6 2 4 Our Responsibility Committee is focused on ensuring continued diversity on the Board during refreshment activities by requiring that candidate pools include diverse individuals meeting the recruitment criteria. Kimberly Underhill E H R Independent Senior Advisor of Boston Consulting Group Age: 57 Director Since: 2016 Tristan Walker F R Independent Founder and Chief Executive Officer of Walker & Company Brands Inc. Managing Member of Heirloom Management Company, LLC Age: 37 Director Since: 2020 Other Public Company Board: Shake Shack Inc. Ulice Payne, Jr. A E R Independent President of Cyber-Athletix, LLC President and Managing Member of Addison-Clifton, LLC Age: 66 Director Since: 2016 Other Public Company Boards: ManpowerGroup Inc. WEC Energy Group, Inc. REFRESHMENT Over past years new directors added and, as of 2022 Annual Meeting, directors will have retired Foot Locker, Inc. Policy: Retirement Age 72 Steven Oakland E F R Independent Chief Executive Officer and President of TreeHouse Foods, Inc. Age: 61 Director Since: 2014 Other Public Company Board: TreeHouse Foods, Inc. Dona D. Young A E R Lead Independent Director Independent executive and board consultant Retired Chairman, President and Chief Executive Officer of The Phoenix Companies, Inc. Age: 68 Director Since: 2001 Other Public Company Board: Aegon N.V. 2022 PROXY STATEMENT 17

ProposalPROPOSAL 1: Election of DirectorsELECTION OF DIRECTORS

| ||

| Chairman Chief Executive | |

| Age: 64 | ||

Director since: 2014

|  | |

PROFESSIONAL EXPERIENCE

Foot Locker, Inc.

| ► | Chairman, since May 2016 |

| ► | President and Chief Executive Officer, since December |

OTHER BOARD SERVICE

| ► | Director and |

| ► | Director, Maidenform Brands, Inc. |

| Chairman, |

| ► | Director, FDRA |

| ► | Member, University of Wisconsin—Eau Claire National Leadership |

REASONS FOR NOMINATION

Mr. Johnson has extensive experience as a retail company chief executive, including 25 years at the Company. He has led almost all of the Company’s major businesses in the United States, International, and Direct-to-Customer, has extensive knowledge of all facets of the Company’s business, and played an integral role in developing and executing the Company’s strategic plans.

| RELEVANT SKILLS | |

|  |

| DONA D. YOUNG | |

| Lead Independent Director | |

| Age: 68 | ||

Director since:

|  | |

PROFESSIONAL EXPERIENCE

|

Independent executive and board consultant

The Phoenix Companies, Inc. (insurance and asset management company)

|

Proposal 1: Election of Directors

|

|  |

OTHER BOARD SERVICE

| ► | Chairman of the |

| ► | Vice Chair of Audit |

| ► | ||

|

|  |

| ► | Board Member, Spahn & Rose Lumber Co. |

| ► | Director and |

| ► | Director and member of the Audit Committee, Save the Children U.S. |

| ► | Trustee, Saint James School in Saint James, Maryland |

REASONS FOR NOMINATION

Ms. Young has significant governance, legal, mergers and acquisitions, risk management, and financial experience given her prior service as a public company General Counsel, and later CEO, which are relevant in her role as Lead Independent Director. The education and experience Ms. Young acquired through her board service at Save the Children are useful in her oversight of the Company’s human rights efforts. In addition, she was named by the Financial Times’ Outstanding Directors Exchange as a member of its Outstanding Directors class of 2021, the NACD Directorship 100 for 2015, and a NACD Board Leadership Fellow since 2013. She is NACD Directorship Certified™, completed the NACD Cyber-Risk Oversight Program, earned a CERT Certificate in Cybersecurity Oversight conferred by Carnegie Mellon University, and was a 2012 Advanced Leadership Fellow at Harvard University.

| COMMITTEES | RELEVANT SKILLS |

| A E R |  |

18 | Foot Locker, Inc. |

PROPOSAL 1: ELECTION OF DIRECTORS

| VIRGINIA C. DROSOS |

| |

| Age: 59 | |

Director since: 2022 | |

PROFESSIONAL EXPERIENCE

Signet Jewelers Limited (specialty jewelry retailer)

| ► | Chief Executive Officer, since August 2017 |

Assurex Health, Inc. (personalized medicine company)

| ► | President and Chief Executive Officer, August 2013 to July 2017 |

OTHER BOARD SERVICE

| ► | Director, Signet Jewelers Limited, since 2012 |

| ► | Director, Akron Children’s Hospital, since April 2019 |

| ► | Director, American Financial Group, Inc., 2013 to December 2021 |

| ► | Director, Assurex Health, Inc., August 2013 to July 2017 |

REASONS FOR NOMINATION

Ms. Drosos brings valuable skills and insights to the Board, including proven expertise in strategy, branding, marketing, digital commerce, and global operations. She has proven retail expertise in mergers and acquisitions and business expansions into new product lines, retail channels, and geographies. Ms. Drosos is the sitting CEO of a specialty retailer, she is a visionary and transformational leader with an entrepreneurial mindset, and she has a proven track record of growing and scaling global businesses through deep consumer understanding, product and experience innovation, and heightened employee engagement. Further, Ms. Drosos is actively involved in financial planning issues as the CEO of a public company, providing her with relevant expertise as a member of the Audit Committee and Finance Committee.

| COMMITTEES | RELEVANT SKILLS |

| A F |  |

| ALAN D. FELDMAN |

| Independent Director | |

| Age: 70 | |

| |

PROFESSIONAL EXPERIENCE

Midas, Inc. (automotive repair and maintenance service provider)

| ► | Chairman, President and Chief Executive Officer, May 2006 to April 2012 |

| ► | President and Chief Executive Officer, January 2003 to April 2006 |

OTHER BOARD SERVICE

| ► | Director, John Bean Technologies Corporation, since July 2008 |

| ► | Director, GNC Holdings, Inc., June 2013 to June 2020 |

| ► | Director, Foundation Board, University of Illinois Foundation, since September 2012 |

REASONS FOR NOMINATION

Mr. Feldman has extensive chief executive, financial, and franchised retail experience as the former CEO of a public company specializing in retail franchises, providing him with relevant expertise as a member of the Human Capital Committee and Finance Committee.

| COMMITTEES | RELEVANT SKILLS |

| F H |  |

| 2022 PROXY STATEMENT |  19 |

PROPOSAL 1: ELECTION OF DIRECTORS

| GUILLERMO G. MARMOL |

| Independent Director | |

| Age: 69 | |

Director since: 2011 | |

PROFESSIONAL EXPERIENCE

Marmol & Associates (consulting firm that provides advisory services and investment capital to early-stage technology companies)

| ► | President, since March 2007 and October 2000 to May 2003 |

OTHER BOARD SERVICE

| ► | Non-executive Chief Executive Officer, Viron Therapeutics Holdings Inc., since 2021 |

| ► | Director and Audit Committee member, Morae Global Corporation, until August 2021 |

| ► | Director, Vitamin Shoppe, Inc., February 2016 to December 2019 |

| ► | Chair of the Board of Trustees, Center for a Free Cuba |

REASONS FOR NOMINATION

Mr. Marmol has a significant background in information technology and systems, which is highly important to the Company as we continue to invest in our technology and systems and build a more powerful digital business to connect with our customers. Mr. Marmol also has extensive executive, financial, strategic analysis, and business process experience as a management consultant at Marmol & Associates and McKinsey & Company and a former senior executive officer of Luminant Worldwide Corporation, Electronic Data Systems Corporation, and Perot Systems Corporation, providing him with relevant expertise as a member of the Human Capital Committee and Audit Committee Chair.

| COMMITTEES | RELEVANT SKILLS |

|  |

| DARLENE NICOSIA |

| Independent Director | |

| Age: 54 | |

Director since: 2020 | |

PROFESSIONAL EXPERIENCE

The Coca-Cola Company (beverage company)

| ► | President, Canada and Northeast U.S., North America Operating Unit, since January 2021 |

| ► | President of the Canada Business Unit, January 2019 to January 2021 |

| ► | Vice President, Commercial Product Supply, May 2016 to January 2019 |

OTHER BOARD SERVICE

| ► | Advisory Board Member, Georgia Institute of Technology, Scheller College of Business |

| ► | Chair of the Board, Canadian Beverage Association |

| ► | Member, Food, Health, and Consumer Products of Canada Association |

REASONS FOR NOMINATION

Ms. Nicosia brings to our Board a broad-based global business background, particularly brand-building and global supply chain management, gained through her experience in the consumer products industry. Throughout her career, Ms. Nicosia has led sustainability initiatives and navigated complex regulatory environments and shifting consumer preferences. Her extensive understanding of supply chain, marketing operations, third-party risk management, and business transformation is an asset to our Board, particularly our Audit Committee and Human Capital Committee.

| COMMITTEES | RELEVANT SKILLS |

| A H |  |

20 | Foot Locker, Inc. |

ProposalPROPOSAL 1: Election of DirectorsELECTION OF DIRECTORS

| ||

| Independent Director | |

| Age: 61 | ||

Director since:

|  | |

PROFESSIONAL EXPERIENCE

TreeHouse Foods, Inc. (manufacturer of packaged foods and beverages)

| ► | Chief Executive Officer and President, since March 2018 |

The J.M. Smucker Company (manufacturer of packaged foods and beverages)

| ► | Vice Chair and President, U.S. Food and Beverage, May 2016 to March 2018 |

| ► | President, Coffee and Foodservice, April 2015 to April 2016 |

OTHER BOARD SERVICE

| ► | Director, TreeHouse Foods, Inc. |

| ► | Director and member of Compensation committee, Foster Farms |

| ► | Director, Food Industry Association |

| ► | Director, MTD Products, Inc., until December 2021 |

REASONS FOR NOMINATION

Mr. Oakland brings to our Board a broad-based business background and extensive experience in domestic and international consumer products operations, with particular strengths around business development, mergers and acquisitions, risk management, strategic planning, customer engagement, marketing, and brand building. Mr. Oakland is actively involved in governance and financial matters as the sitting CEO of a public company, providing him with relevant expertise as a member of the Responsibility Committee and Finance Committee Chair.

| COMMITTEES | RELEVANT SKILLS |

|  |

| ULICE PAYNE, JR. |

| Age: 66 | |

Director since: 2016 | |

PROFESSIONAL EXPERIENCE

Cyber-Athletix, LLC (esports healthcare company)

| ► | President, since March 2021 |

Addison-Clifton, LLC (global trade compliance advisory services provider)

| ► | President and Managing Member, |

OTHER BOARD SERVICE

| ► | Director and |

| ► | Director and member of |

| ► | Director, Wisconsin Conservatory of |

| ► | Director, The Northwestern Mutual Life Insurance Company, |

REASONS FOR NOMINATION

Mr. Payne brings to our Board significant governance, operational, financial, public service, trade compliance, and international experience as a result of the many senior positions he has held, including as President and Managing Member of Addison-Clifton, LLC since May 2004, President and Chief Executive Officer of the Milwaukee Brewers Baseball Club from September 2002 to December 2003, Managing Partner of Foley & Lardner, LLP from 2001 to 2002, Partner of Foley & Lardner, LLP from February 1998 to September 2002, and the Wisconsin Commissioner of Securities from February 1985 to December 1987. Mr. Payne’s extensive experience provides him with relevant expertise as a member of the Audit Committee and Responsibility Committee Chair.

| RELEVANT SKILLS | ||

|

|  |

| ||

|

|

ProposalPROPOSAL 1: Election of DirectorsELECTION OF DIRECTORS

| ||

| Independent Director | |

| Age: 57 | ||

Director since:

|  | |

PROFESSIONAL EXPERIENCE

Boston Consulting Group (management consulting firm)

| ► | Senior Advisor, since November 2021 |

Kimberly-Clark Corporation (manufacturer of branded personal care, consumer tissue, and professional healthcare products)

| ► | President, North America Consumer, |

| ► | Global President of Kimberly-Clark Professional, |

OTHER BOARD SERVICE

| ► | Advisory board member, |

| ► | Director, Board of |

| ► | Co-Chair and Leadership Giving Chair, United Way Fox Cities Campaign |

| ► | Director and Compensation Committee Chair, Network of Executive Women, |

| ► | Director, Kimberly-Clark de Mexico, S.A.B. de C.V., until September 2021 |

| ► | Director, Food Industry Association, until 2021 |

REASONS FOR NOMINATION

Ms. Underhill brings to our Board a broad-based business background and extensive experience in domestic and international consumer products operations, with particular strengths in marketing, brand building, strategic planning, international business, and business development. She is NACD Directorship CertifiedTM. Ms. Underhill’s management resources experience from her prior service as a senior executive of a public company is relevant to both our Human Capital Committee, of which she is Chair, and Responsibility Committee, of which she is a member.

| RELEVANT SKILLS | |

|  |

| TRISTAN WALKER | |

| ||

| Age: 37 | ||

|  | |

PROFESSIONAL EXPERIENCE

Walker & Company Brands Inc. (manufacturer of health and beauty products for persons of color), a subsidiary of the Procter & Gamble Company

| ► | Founder and Chief Executive Officer, |

Heirloom Management Company, LLC (micro venture capital fund)

| Managing Member, since March 2022 |

OTHER BOARD SERVICE

| ► | Director, Shake Shack, Inc. |

| ► | Trustee, Children’s Healthcare of Atlanta |

| ► | Chairman, CODE2040 (non-profit organization that matches high-performing Black and Latino software engineering students and graduates with technology firms and start-ups), until January 2020 |

REASONS FOR NOMINATION

Mr. Walker’s brand marketing and technology experience are deeply connected to the mission of designing solutions for consumers while bridging the gap between technology product innovation and youth culture. Mr. Walker understands how to utilize innovation and technology to drive change and deliver growth. His work at the intersection of technology and the consumer experience benefits our Board, and his financial and ESG experience as a CEO provides him with relevant expertise as a member of the Finance Committee and Responsibility Committee.

| COMMITTEES | RELEVANT SKILLS |

| F R |  |

| Foot Locker, Inc. |

ProposalPROPOSAL 1: Election of DirectorsELECTION OF DIRECTORS

Summary of Director Qualifications and Experience and Demographic MatrixDIRECTOR NOMINEES’ SKILLSET MATRIX

We believe that our slate ofthe director nominees possessespossess the appropriate mix of diversity in terms of gender, age, ethnicity, skills, business experience, service on ourand Board and the boards of other organizations,experience, and viewpoints. We have refreshed our Board over the past five years, as threefive highly-qualified directors were added to the Board and, threeas of the Annual Meeting, five directors retired. will have retired during that time period.

| 2022PROXY STATEMENT |  23 |

PROPOSAL 1: ELECTION OF DIRECTORS

Each director is individually qualified to make unique and substantial contributions. Collectively, our directors’ diverse viewpoints and independent-mindedness enhance the quality and effectiveness of Board deliberations and decision making. This blend of qualifications, attributes, and tenure results in highly effective leadership and is summarized below.highly-effective oversight.

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| |||||||||||

| Foot Locker, Inc. | |||||||||||

|

Proposal 1: Election of Directors

| Knowledge, Skills, and Experience | Clark | Feldman | Johnson | Marmol | McKenna | Oakland | Payne | Turpin | Underhill | Young | |

| Technology and Systemsexperience is important given the importance of technology to the retail marketplace, our internal operations, and our customer engagement initiatives | ● | ● | ||||||||

| Youth Culture/Target Marketexperience is important to understand our business and strategy as our brands keenly focus on their target customers, particularly youth culture | ● | ● | ● | ● | ||||||

| Governance | |||||||||||

| Accounting or Financialexpertise gained from experience as a CEO, audit professional, or finance executive is important because it assists our directors in understanding and overseeing our financial reporting and internal controls | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Business Development / Mergers and Acquisitionsexperience is important because it helps in assessing potential growth opportunities | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Environmental, Social, and Governanceexperience is important because it supports our goals of strong Board and management accountability, transparency, and protection of shareholder interests | ● | ● | ● | ● | ● | ● | ● | |||

| Risk Managementexperience is helpful to the Board’s role in overseeing the risks facing the Company | ● | ● | ● | ● | ● | ● | ||||

| Demographic Background | |||||||||||

| Board Tenure (Year Joined) | 2013 | 2005 | 2014 | 2011 | 2006 | 2014 | 2016 | 2001 | 2016 | 2001 | |

| Years | 6 | 14 | 5 | 8 | 13 | 5 | 3 | 18 | 3 | 18 | |

| Gender | ● | ● | ● | ● | ● | ● | |||||

| Male | ● | ● | ● | ● | |||||||

| Female | |||||||||||

| Age (at April 12, 2019) | |||||||||||

| Years old | 70 | 67 | 61 | 66 | 68 | 58 | 63 | 71 | 54 | 65 | |

| Race/Ethnicity | |||||||||||

| African American | ● | ||||||||||

| Hispanic | ● | ||||||||||

| White | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Number of Other Public Company Boards | 1 | 2 | 1 | 1 | — | 1 | 2 | — | — | 1 | |

|

The Board is committed to good corporate governance and has adopted Corporate Governance Guidelines and other policies and practices to guide the Board and senior management.OUR BOARD OF DIRECTORS

Our By-Laws provide for a Board consisting of between 7 and 13 directors. The exact number of directors is determined from time to time by the entire Board. TheThere are currently 11 directors on our Board. Mr. McKenna will be retiring when his term expires at the conclusion of the Annual Meeting, and the Board has fixed the number of directors at 10 and there are currently 10 directors on our Board.effective at such time.

Directors’ IndependenceDIRECTORS’ INDEPENDENCE

A director is not considered independent under New York Stock Exchange (“NYSE”)NYSE rules if he or she hasthey have a material relationship with the Company that would impair his or hertheir independence. In addition to the independence criteria established by the NYSE, the Board has adopted categorical standards to assist it in making its independence determinations regarding individual directors. These categorical standards are contained in the Corporate Governance Guidelines, which are posted on the Company’s corporate websiteavailable atfootlocker.com/corpinvestors.footlocker-inc.com/cgg.

The Board has determined that the following categories of relationships are immaterial for purposes of determining whether a director is independent under the NYSE listing standards:

| Categorical Relationship | Description |

| Investment Relationships with the Company | A director and any family member may own equities or other securities of the Company. |

| Relationships with Other Business Entities | A director and any family member may be a director, employee (other than an executive officer), or beneficial owner of less than 10% of the shares of a business entity with which the Company does business, provided that the aggregate amount involved in a fiscal year does not exceed the greater of $1 million or 2% of either that entity’s or the Company’s annual consolidated gross revenue. |

| Relationships with Not-for-Profit Entities | A director and any family member may be a director or employee (other than an executive officer or the equivalent) of a not-for-profit organization to which the Company (including the Foot Locker Foundation) makes contributions, provided that the aggregate amount of the Company’s contributions in any fiscal year do not exceed the greater of $1 million or 2% of the not-for-profit entity’s total annual receipts. |

We individually inquire of each of our directors and executive officers about any transactions in which the Company and any of these related persons or their immediate family members are participants. We also make inquiries within the Company’s records for information on any of these kinds of transactions. Once we gather the information, we then review all relationships and transactions of which we are aware in which the Company and any of our directors, executive officers, their immediate family members, or five-percent5% shareholders are participants to determine, based on the facts and circumstances, whether the related persons have a direct or indirect material interest. TheOur General Counsel’s office coordinates the related person transaction review process. The Nominating and GovernanceResponsibility Committee reviews any reported transactions involving directors and their immediate family members in making its recommendation to the Board on the independence of the directors. In approving, ratifying, or rejecting a related person transaction, the Nominating and GovernanceResponsibility Committee considers such

|

Corporate Governance

information as it deems important to determine whether the transaction is on reasonable and competitive terms and is fair to the Company. The Company’s written policies and procedures for related person transactions are included within both the Corporate Governance Guidelines and the Code of Business Conduct. There were no related person transactions in 2018.2021.

| 2022PROXY STATEMENT |  25 |

GOVERNANCE

The Board, upon the recommendation of the Nominating and GovernanceResponsibility Committee, has determined that the following directors are independent under the NYSE rules because they have no material relationship with the Company that would impair their independence:

|  |  |  |  |

DONA D. YOUNG Age: 68 Director since: 2001 Lead Independent Director | VIRGINIA C. DROSOS Age: 59 Director since: 2022 | ALAN D. FELDMAN Age: 70 Director since: 2005 | GUILLERMO G. MARMOL Age: 69 Director since: 2011 | MATTHEW M. MCKENNA Age: 71 Director since: 2006 |

|  |  |  |  |

DARLENE NICOSIA Age: 54 Director since: 2020 | STEVEN OAKLAND Age: 61 Director since: 2014 | ULICE PAYNE, JR. Age: 66 Director since: 2016 | KIMBERLY UNDERHILL Age: 57 Director since: 2016 | TRISTAN WALKER Age: 37 Director since: 2020 |

Jarobin Gilbert, Jr. served as a director of the Company during 2018 until his retirement from the Board in May 2018. The Board determined that Mr. Gilbert was independent under NYSE rules through the end of his term as a director because he had no material relationship with the Company that would impair his independence.

In making its independence determination, the Board reviewed recommendations of the Nominating and Governance Committee and considered Dona D. Young and Ulice Payne, Jr.’s

directors are independent. All directors are independent, except the CEO. | Maxine Clark served as a director of the Company during 2021 until her retirement from the Board in May 2021. The Board determined that Ms. Clark was independent under NYSE rules through the end of her term as a director because she had no material relationship with the Company that would impair her independence. In making its independence determination, the Board reviewed recommendations of the Responsibility Committee and considered Mr. Payne and Ms. Young’s relationships as directors of companies with which we do business. The Board has determined that these relationships meet the categorical standard for Relationships with Other Business Entities and are immaterial with respect to determining independence. The Board has determined that all members of the Audit Committee, the Finance Committee, the Human Capital Committee, and the Responsibility Committee are independent as defined under the NYSE listing standards and the director independence standards adopted by the Board. |

26 | Foot Locker, Inc. |

GOVERNANCE

BOARD TENURE AND TERM LIMITS

The Company is focused on having a well-constructed and high-performing Board. To that end, the Responsibility Committee selects director nominees who think and act independently and can clearly and effectively communicate their convictions. The Board does not believe long tenure alone presumptively renders a director to not be independent. Conversely, the Board recognizes the contributions experienced directors add to the Board. The Board has determined that these relationships meetits longer-tenured directors have important experience, bring diverse perspectives, and provide tangible value to the categorical standard for Relationships with Other Business EntitiesBoard and are immaterial with respect to determining independence.

the Company. The Board has also determined that all memberstheir length of tenure has allowed these directors to accumulate valuable knowledge and experience based upon their history with the Company. This knowledge and experience improves the ability of the Audit Committee,Board to provide constructive guidance and informed oversight to management. Furthermore, in the Compensation Committee,Board’s opinion, the Finance Committee,length of tenure of its members has not in any way impaired the willingness of any director to question and confront any issue or exercise independent and impartial oversight of the Nominating and Governance Committee are independent as defined underCompany in any area. The Board benefits from the NYSE listing standards andcontributions of its experienced directors who have developed insight into the director independence standards adopted byCompany over the course of their service on the Board.

The Responsibility Committee has specifically considered the feedback of some shareholders as well as the discussions of some commentators that suggest lengthy Board Leadership Structuretenure should be balanced with new perspectives. Specific to the Company, the Responsibility Committee has structured the Board such that there are directors of varying tenures, with new directors and perspectives joining the Board over time while retaining the institutional memory of longer-tenured directors. Longer-tenured directors, balanced with newer directors, enhance the Board’s oversight capabilities. The Board believes it is important to balance refreshment with the need to retain directors who have developed, over time, significant insight into the Company and its operations and who continue to make valuable contributions to the Company that benefit our shareholders. The Board believes that it has an appropriate mix of longer-tenured directors and newer directors, which provides an appropriate and dynamic balance.

Furthermore, the Board has not adopted formal director term limits, in part, because the imposition of director term limits on a board implicitly discounts the value of experience and continuity among directors and runs the risk of excluding experienced and potentially valuable directors as a result of an arbitrary determination. In addition, imposing this restriction means the Board would lose the contributions of longer-tenured directors who have developed a deeper knowledge and understanding of the Company over time. The Board does not believe that long tenure impairs a director’s ability to act independently of management.

BOARD LEADERSHIP STRUCTURE

Our Board evaluates, from time to time as appropriate, whether the same person should serve as Chairman and Chief Executive Officer,CEO, or whether the positions should be held by different persons, in light of all relevant facts and circumstances and what it considers to be in the best interests of the Company and our shareholders. Since May 2016, the positions of Chairman and Chief Executive OfficerCEO have been held by Richard A.Mr. Johnson, with Dona D.Ms. Young serving as independent Lead Independent Director. The Board has utilized various leadership structures since 2010, as shown below:

| |||

Lead Director

The Board believes that, particularlybased on the Company’s current facts and circumstances, its Board leadership structure is appropriate.

| 2022PROXY STATEMENT |  27 |

GOVERNANCE

LEAD INDEPENDENT DIRECTOR

The Board believes that, because the positions of Chairman and Chief Executive OfficerCEO are held by the same person, the appointment of ancombined, a lead independent lead director is appropriate.

The Lead Independent Director’s responsibilities include:

| ► | presiding at executive sessions of the independent directors, and Board meetings at which the Chairman is absent; |

| attending meetings of each of the Board committees; |

| ► | encouraging and facilitating active participation by, and communication among, all directors; |

| ► | serving as the liaison between the independent directors and the Chairman; |

| ► | approving Board meeting agendas and schedules after conferring with the Chairman and other members of the Board, as appropriate, and adding agenda items in her discretion; |

| ► | possessing the authority to call meetings of the independent directors; |

| ► | leading the Board’s annual CEO performance evaluation; |

Corporate Governance

| ► | advising the Chairman and the committee chairs in fulfilling their designated roles and responsibilities; and |

| ► | performing such other functions as the Board or other directors may request. |

The Board periodically considers the periodic rotation of the Lead Independent Director, from time to time, taking into account experience, continuity of leadership, and the best interests of the Company.

Dona D.Ms. Young currently serves as the Lead Independent Director. The Board believes that Mrs.Ms. Young is well suited to serve as Lead Independent Director, given her governance, business, and financial and governance background,background. The Board also recognizes that it benefits from Ms. Young’s tenure as well asan experienced director who has developed insight into the Company over the course of her more than eighteen years of service on our Board.the Board, which improves her ability to provide constructive, independent, and informed guidance and oversight to management.

NOTE FROM OUR LEAD INDEPENDENT DIRECTOR

Director On-BoardingDespite the many challenges we confronted and Educationare continuing to experience—including impacts related to the COVID-19 pandemic, supply chain disruption, inflationary pressures, and an evolving geopolitical environment—we delivered record performance in 2021. While it is important to celebrate this achievement, the Board, like management, never rests because we recognize certain headwinds in the marketplace. Our Board is engaged in confronting these challenges and believes that our strategic plan puts the Company in a position of strength. On behalf of the Board, I am pleased to share with you some highlights of the governance work we have done to navigate these challenges and make strategic choices to create long-term, consistent shareholder value:

| ► | Long-Term Strategy Oversight. The Board has overseen the long-term strategy initiatives implemented in 2021 to diversify our brands, categories, and channels, as well as expand our demographic and geographic customer base with the acquisitions of WSS and atmos. As the business and industry continue to evolve, the Board remains engaged and committed to accelerating certain initiatives in 2022 as a part of our long-term strategy to address the accelerated strategic shift to DTC by our vendors while also returning capital to shareholders, including further diversification of our merchandise and vendor mix, accelerating our off-mall pivot and key growth banner rollout, enhancing omni-channel evolution efforts, and implementing a new cost savings program. |

| ► | Board Refreshment. Ongoing Board refreshment is critical to ensure we have the right mix of skills, diversity, and expertise to support the Company’s progress. We recently strengthened our Board with the election of Gina Drosos in February 2022 in anticipation of Matt McKenna’s retirement from the Board in May 2022. Gina brings significant financial, industry, and operational experience from her current role as a sitting CEO of a speciality retailer. |

| ► | Succession Planning. The Board believes that a high-performing management team is critical to our success as a global brand that leads with purpose. To ensure we have the appropriate succession plan in place, the full Board is engaged in a long-term process with management to maximize the pool of emerging diverse talent who possess the skills, experiences, and attributes required to be effective leaders in light of the Company’s global business strategies, opportunities, and challenges. For additional information, see Human Capital Management and Succession Planning Oversight on page 34. |

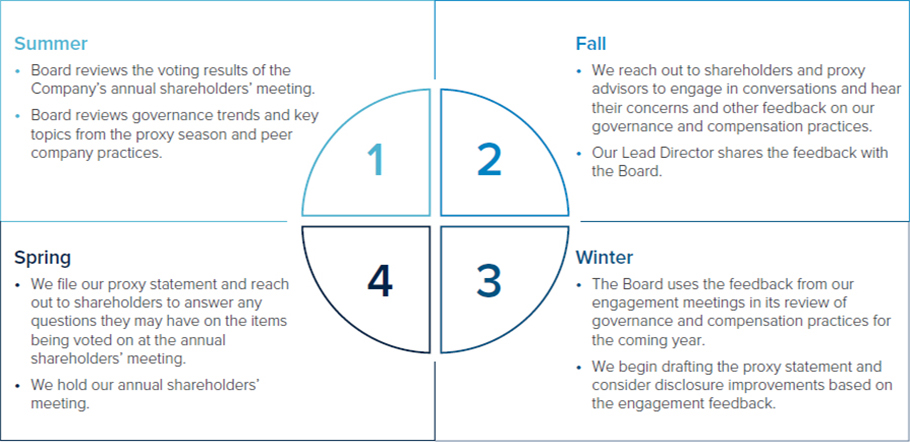

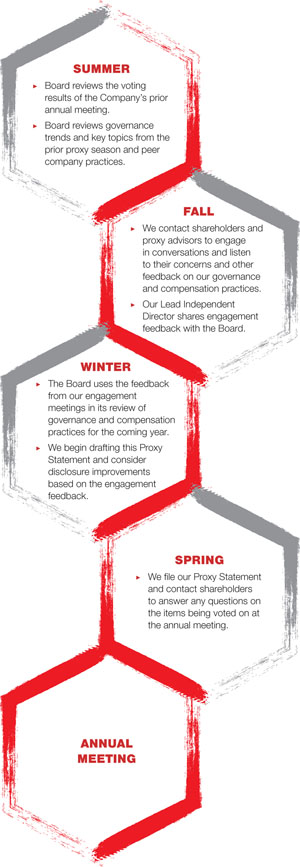

| ► | Shareholder Engagement. Our Board serves at the pleasure of you, our shareholders. Therefore, as a Board, one of our highest priorities is hearing from you, our shareholders, who have entrusted us with this responsibility. For the past five years, I have led, on behalf of our Board, a structured and governance-focused shareholder engagement program designed to accomplish this by facilitating transparency and creating a platform to receive shareholder feedback to share with the Board. For additional information, see Shareholder Engagement on page 38. |

| ► | ESG. ESG is embedded in our ability to achieve our strategic imperatives. The Board has worked with management in its oversight capacity to support the integration of its ESG efforts into its over-arching growth strategy, as illustrated in our Impact Report. For example, we believe DIBs is a strategic business driver. Management and the Board have been tested in multiple ways throughout the pandemic and our diversity has proven to be an important asset, which has led us to make better strategic decisions. For additional information regarding our global ESG program and Board oversight, see ESG on page 96, ESG Oversight on page 35, and our Impact Report, which is available at investors.footlocker-inc.com/impactreport. |

The Board is incredibly grateful to all our stakeholders for their continued commitment to supporting the Company.

| “While the Board knows that it is important to celebrate the Company’s record performance in 2021, the Board, like management, never rests because we recognize certain headwinds in the marketplace and our oversight responsibility to make the strategic decisions necessary to create long-term, consistent value for you, our shareholders.” DONA D. YOUNG Lead Independent Director |

28 | Foot Locker, Inc. |

GOVERNANCE

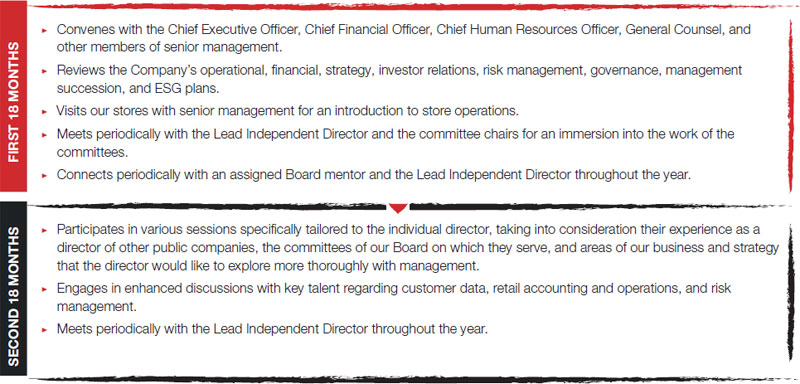

DIRECTOR ON-BOARDING

We have ana two-phase on-boarding program for new directors that is intended to educate a new director on the Company and the Board’s practices. During the first year of the director’s service, the newly-electedpractices:

DIRECTOR CONTINUING EDUCATION

Director education is an ongoing process, which begins when a director meets with the Company’s Chief Executive Officer, Chief Financial Officer, Chief Human Resources Officer, General Counsel and Secretary, and other members of senior management, to review the Company’s business operations, financial matters, strategy, investor relations, risk management, corporate governance, composition of thejoins our Board. We host quarterly Board and its committees,committee presentations and succession and development plans. Additionally, he or she visits our stores nearseparate education sessions to keep directors appropriately apprised of key developments concerning the Company’s New York headquarters, and elsewhere, with senior management for an introduction to store operations. During this first year, new directors periodically meet with the Lead Director and with the committee chairs for an immersion into the work of the committees.following topics so they can effectively carry out their oversight responsibilities: